Inflation Affects GenZ

The gallon of milk, which in the 1920s, would set you back about 35 cents per gallon, has increased to almost 4 U.S. dollars over the last century.

This process occurs due to a sharp decrease in productivity; otherwise known as inflation.

Inflation is the general rise in the economy’s cost of goods and services or the devaluation of a country’s currency.

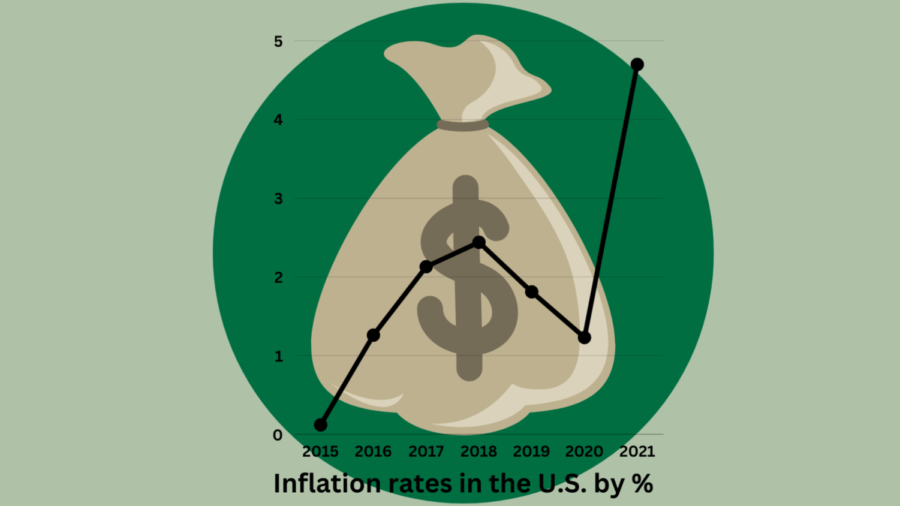

The consumer price increase is inevitable; according to the International Monetary Fraud, economists aim for a slow inflation rate of 2% per year.

Costs for items such as fuel, energy, and food continue to increase as the years pass.

CPI shows one of the most significant increases in 1981, up 9.1%.

Today, higher costs for labor, lower production, and even the current war in Ukraine are contributing to the incline of consumer prices this year.

Some people believe that Gen Z is not ready for the amount of financial tragedy they are about to face.

The majority of minimum-wage jobs pay their staff every two weeks, leaving very little room to catch up to the piling bills.

College debt, housing costs, and even everyday food prices are invading every by-weekly paycheck.

“Over 30% of working Gen Z uses almost half of their paycheck towards rent or the mortgage…that’s an estimated 10% increase from a few years back,” said Media Manager Rick Munster at Money Fit by DRS.

Inflation is leaving many Americans forced to live paycheck to paycheck.

Researchers also said, “many are struggling under debt from college, with 34% of adults aged 18 to 29 holding student loans”

The state of Arizona’s average tuition cost lies at $12,266 per semester; growing about 8% in the last year.

Past generations have all been affected by inflation in their own unique way.

Government and Economics Teacher Joyce Baird said, “Baby Boomers are far more affected by inflation due to their paychecks remaining the same as inflation rises…Gen Zers can move in with their parents or get new jobs”.

While Gen Z is in their prime years, knowing about inflation could greatly affect their finances entering adulthood.

Baird also said, “I think Gen Z has plenty of time to prepare for the consequences of inflation.”

Saving money, eliminating spending habits, and requesting financial assistance are all things Gen Zers should consider.