Unbeknownst to most people, an ultra-powerful company is moving the hands of countries at their own will.

BlackRock, the world’s largest asset manager, controls over 12.5 trillion dollars in assets.

The company has been a world power that shows no signs of slowing down.

Since its beginning, BlackRock had been fueled by controversial methods and decisions.

Here is a detailed account of BlackRock and its dark secrets:

The legendary BlackRock CEO, Larry Fink, has craved power and influence from a young age.

Fink attended UCLA, majoring in Political Science to attempt to pursue that dream; then an epiphany arose.

Fink began to understand that power doesn’t necessarily come from politics, but that it comes from money and ownership.

After graduating from UCLA, he started at First Boston Investment Bank, quickly rising through the ranks.

Soon, Fink became the youngest Managing Director ever at just 27 years old and essentially pioneered a new financial instrument called Mortgage-Backed Securities (MBS).

Despite producing $1 Billion for the company during his tenure, in 1986, Fink lost around $100 Million due to incorrect predictions about interest rates and very little risk management; this was the catalyst for not just him, but the world.

Fink lost his job and reputation on Wall Street but, instead of giving up, he ventured out and recruited seven former employees of First Boston Investment Bank to create a financial super team.

Their company grew at rates unheard of and to keep up with it, Fink needed a new advanced technology to help calculate risk and predictions.

In 1999, Asset, Liability, Debt and Derivative Investment Network (Aladdin), an advanced risk/market analysis tool, was created by BlackRock.

In the 2008 recession, BlackRock was able to buy out Barclays Global Investors (BGI) and gain BGI’s leading exchange-traded fund (ETF) and iShares.

Since the creation of Aladdin, the whole market analysis system has been revolutionized and BlackRock’s influence didn’t just become larger, it became suspiciously sinister.

BlackRock is part of the revolving door scheme.

The revolving door scheme is when individuals move from high-level government roles to high influence spots in private sectors.

Since 2004, BlackRock has hired at least 84 former government officials; more than 100 people have been confirmed to move in the revolving door between BlackRock and the government.

A 2025 analysis by OpenSecrets showed that “32 of BlackRocks 44 registered lobbyists previously held government positions”.

People like Former UK Chancellor George Osborn, Former Chairman of Swiss Nation Bank Phillip Hildebrande, Former U.S Secretary of Treasury Henry Paulson, and many more U.S officials with equal or higher status have been a part of this plan.

As of May 6, 2025, former BlackRock chairman Friedrich Merz was elected Chancellor of Germany.

To add to this, Germany is the largest economy in Europe.

This influence has enabled their software to integrate into economies all over the world. The Federal Reserve, European Central Bank, and Japanese Pension Funds all continue to turn to BlackRock’s Aladdin to essentially tell them what decisions to make. The question is: Who’s to say they don’t have the ability to push the information they want certain people to see or to hide the algorithms they want secured?

During the 2008 recession, there was a need to analyze and manage distressed assets from failing financial institutions.

At the time, Treasury Secretary Henry Paulson, helped BlackRock get into this position, which was a turning point in BlackRock’s reputation and power.

BlackRock is classified as a “passive investor”, meaning they use index funds and ETFs instead of directly picking stocks.

When new rules and regulations were being introduced after 2008, BlackRock was exempt from many of these rules due to their status as passive investors.

But, the person who decided this was Fink himself, which gave his company a significant boost against their competitors.

BlackRock’s revolving door is infiltrating governments all over the world and giving themselves more and more power.

Because of this, they are able to abuse this power and find economic loop holes everywhere due to their status.

Additionally, BlackRock flew unnoticed by the majority of people not in government and stocks until the morality of their investments became noticed by the public.

BlackRock invests insane amounts of money into oil companies, fossil fuels, etc. Peaceful and violent protests have ensued towards Fink and the company online and at offices of BlackRock.

Fink began losing public support and decided the company needed to cover up their mistakes.

In 2018, BlackRock began to support Environmental, Social, and Governance (ESG) criteria.

According to RaoGlobal, Fink told the public that sustainability, diversity, and climate action are at the top and center of his investment strategy.

In 2020, he made ESG a standard for all companies he funded and began to pull funding if they didn’t adhere to these standards.

The idea of “forcing behaviors” was his priority, said Fink in a BlackRock’s Annual Letter to CEO’s in 2020.

Inevitably, the publicity stunt began to shine through its cracks.

Despite telling people that BlackRock will move away from these harmful companies, which is 25% of their revenue, they continued to give investors’ money to them.

The former BlackRock Chief Investment Officer Tariq Fancy has claimed multiple times how Blackrock’s ESG investing is all a publicity stunt and “it’s a facade of bullish*t.”

According to Illuminem, “Environmental law group ClientEarth has lodged a greenwashing complaint against BlackRock, accusing the asset management giant of misleading investors by labeling certain fossil fuel-backed funds as ‘sustainable’.”

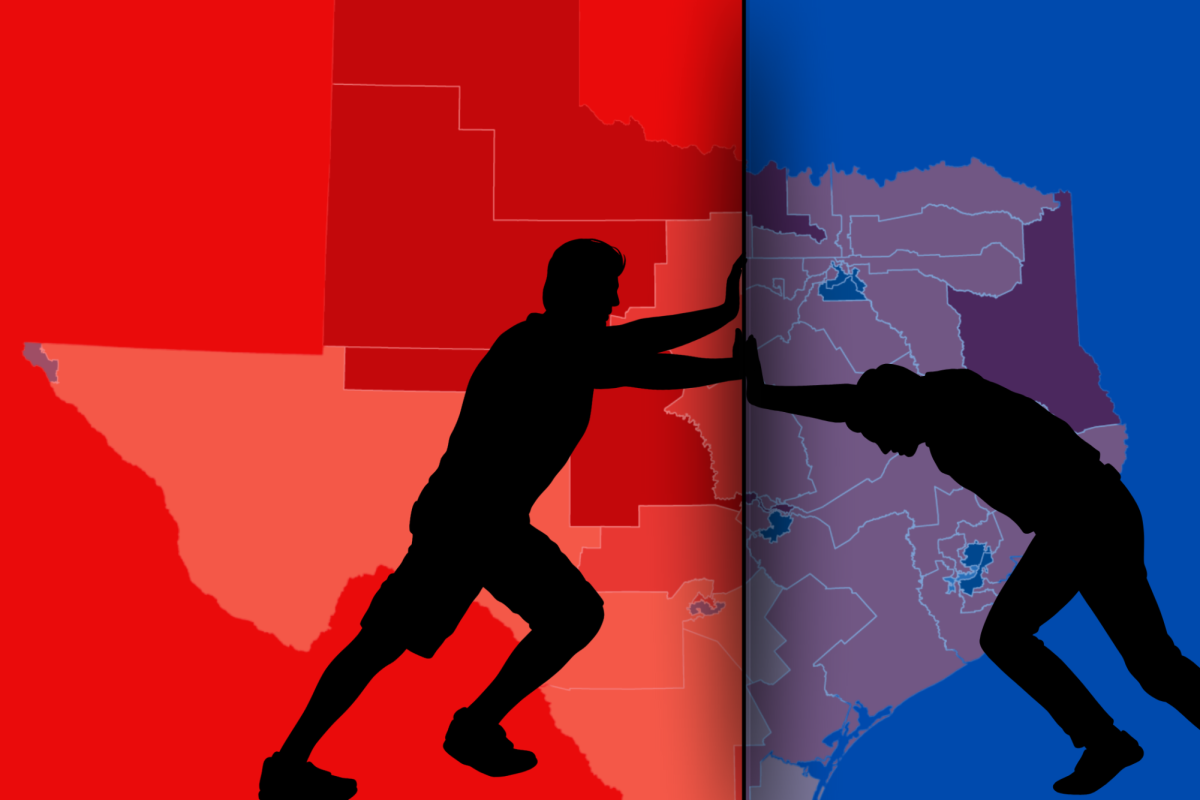

As a result, Florida pulled $2 Billion worth of funding from BlackRock and Texas restricted BlackRock trading during their investigation because BlackRock was suspected of messing with retirement funds.

BlackRock underwent a copious amount of backlash due to their fake ideals and Fink decided to take a step back out of the spotlight.

He stopped all funding for ESG movements and has not mentioned ESG since; because of their silence, they were successfully able to back down out of the spotlight and continue to move in the shadows.

BlackRock holds massive amounts of shares in the defense industry, meaning they profit from war and conflict.

In February of 2022, Russia began invading Ukraine.

Fink, having connections throughout all governments, was able to swoop into Ukraine almost immediately to give them a proposition: Blackrock will provide free help to Ukraine to attract reconstruction funds essentially in return for guaranteed profits on new infrastructure.

All of Ukraine’s infrastructure is in shambles due to the war and BlackRock saw this as an opportunity to profit, not to help people in need.

In early 2025, BlackRock claimed they completed their advisory and halted the investment fund for Ukraine due to Donald Trump’s presidential victory.

Essentially, their goal was to have their private capital flow through war torn regions and take advantage of the horrendous situation.

Anti-war activist group CODEPINK popularized the term “killing on killing” when describing how Blackrock is making profit from investing in war stocks, such as defense and weapons, and investing in those places that need rebuilding after.

An endless money making cycle..

It’s not just Ukraine either, as many predict that when all political controversy ends, Gaza will be a major interest for Blackrock.

From the shadows, a new type of world power has been emerging for decades.

From their political revolving door to their facade of marketing to their even darker relation to the destruction and reconstruction of the world, BlackRock is something that nothing else can control.

They do as they please and until the world chooses to do something about it, the darkness will grow larger and more powerful than ever.